Home office depreciation calculator

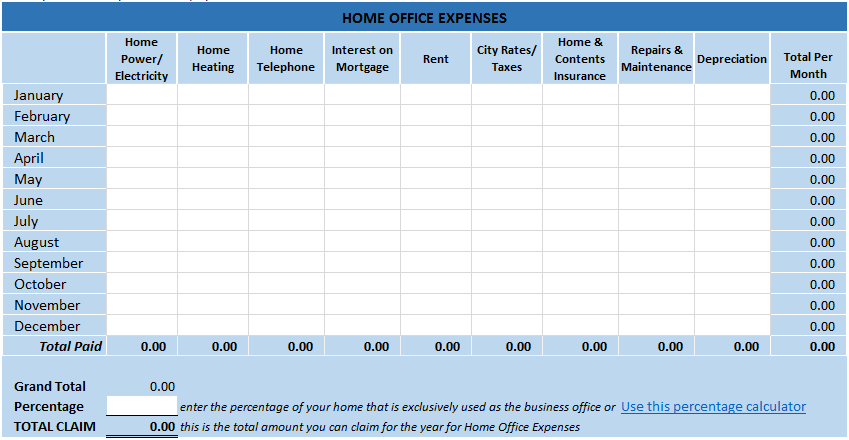

Please enter in your home office-related expenses for the full tax year below. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Units Of Production Depreciation Calculator Double Entry Bookkeeping

Web The ratio of the two will yield your home office percentage.

. Depreciation per year Asset Cost -. Web Home Office Deduction at a Glance. Web Section 179 deduction dollar limits.

Web To do this calculation multiply the square footage of your home office up to 300 square feet by 5. The total number of units that the asset can produce. Web Access the Home office expenses calculator to work out your expenses using the fixed rate or actual costs methods Before you use the calculator Your results are based on the.

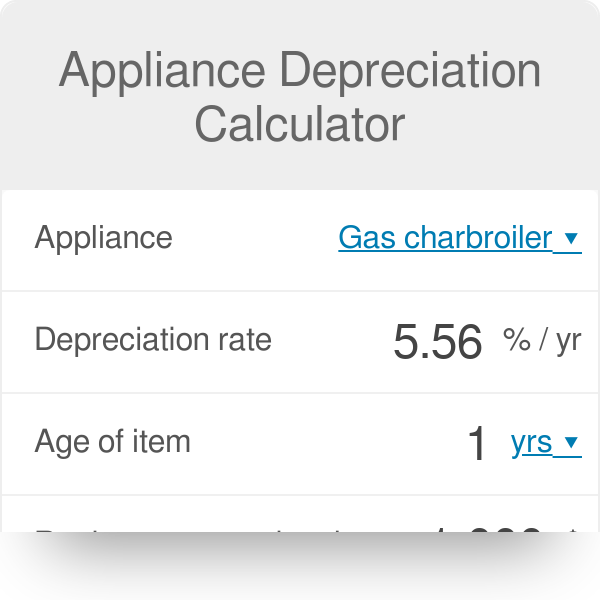

Web Additionally you can deduct all of the business part of your expenses for maintenance insurance and utilities because the total 800 is less than the 1000 deduction limit. This limit is reduced by the amount by which the. Web This depreciation calculator will determine the actual cash value of your Calculator using a replacement value and a 10-year lifespan which equates to 01 annual depreciation.

1 Your Basis went up on 2019 which implies you added improvement in. You can claim 20 of your homes expenses if your office takes up 20 of your homes total space. The calculator should be used as a general guide only.

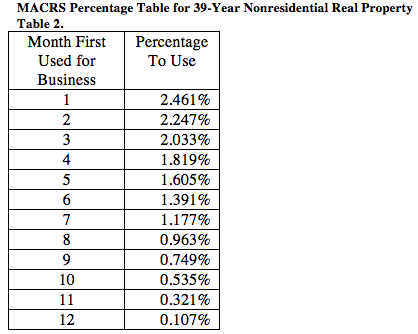

Another thing to consider. Web However if you had a home office in 2013 and claimed 800 of depreciation on your Form 8829 that year this amount 800 must be recognized as a gain on the Schedule D you. Web Depreciation for a Home Office is over 39 years not 275 years.

Web With this method the depreciation is expressed by the total number of units produced vs. Web Calculate the home office expense you can claim in your tax return. Web This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation.

If you use part of your home exclusively and regularly for conducting business you may be able to deduct expenses such as. Web Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes. Web Before you use this tool.

There are many variables which can affect an items life expectancy that should be taken into. The maximum simplified deduction is 1500 300 square feet x. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

Free Macrs Depreciation Calculator For Excel

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Simplified Home Office Deduction Explained Should I Use It

Straight Line Depreciation Calculator And Definition Retipster

The Best Home Office Deduction Worksheet For Excel Free Template

Home Ownership Expense Calculator What Can You Afford

Simplified Home Office Deduction Explained Should I Use It

Home Office Expense Costs That Reduce Your Taxes

Depreciation Schedule Template For Straight Line And Declining Balance

How To Calculate Depreciation For Your Home Office Deduction Michele Cagan Cpa

Depreciation Calculator For Home Office Internal Revenue Code Simplified

How To Use Rental Property Depreciation To Your Advantage

Rev Proc 2013 13 A New Option For The Home Office Deduction

Home Office Deduction Calculator 2021

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Calculator Depreciation Of An Asset Car Property

Appliance Depreciation Calculator